Level 2: Going deeper into nature assessments

How to screen for potential impacts and dependencies on nature?

It is important to measure, value and prioritize your impacts and dependencies on nature to ensure you are acting on the most material ones. However, you don’t need to have granular information up front in order to inform first actions on nature and build up assessment over time.

What frameworks can I use to develop a robust understanding of our company’s relationship with nature?

How have other companies assessed their nature-related issues?

Here are inspiring and practical, in-depth examples of businesses that have applied the ACT-D framework – the High-level business Actions on Nature to Assess, Commit, Transform and Disclose, with a focus on the assess phase and key lessons for each sector:

- For the energy sector from Iberdrola, Equinor and CLP.

- For the Agri-food system from Nutrien and Olam Agri

- For the built environment from Sacyr, Holcim and AECOM

- To illustrate the catalyst role of central banks, from the Dutch National Bank.

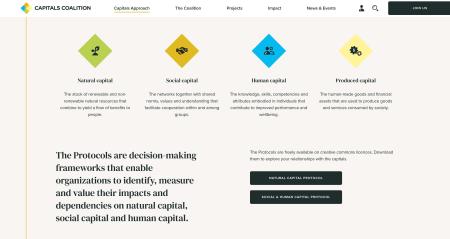

How natural capital assessments can inform decision-making

By using natural capital as an additional lens, businesses can uncover blind spots, strengthen their sustainability strategies, and better align financial, strategic, and environmental performance. This resource is a valuable guide to integrating natural capital thinking across departments, according to the most relevant entry points for the audience, with a clear description of each concept and rich link to external resources. (Note: the document was published in 2020. As this is a fast-moving field, the information on accounting standards is outdated. The International Financial Reporting Standards (IFRS) have been developed by the IFRS Foundation and the International Accounting Standards Board (IASB). Since 2021, it also includes the International Sustainability Standards Board (ISSB).)

Using accounting rigour in nature assessments

Traditional accounting overlooks the value of ecosystem services (e.g., water purification, pollination, flood protection), leading to underinvestment in nature. Natural Capital Accounting (NCA) and Corporate Natural Capital Accounting (CNCA) are emerging frameworks that aim to integrate nature into financial decision-making.